Support Your Foundation

They Manage the Forest. You Can Help Keep It Growing.

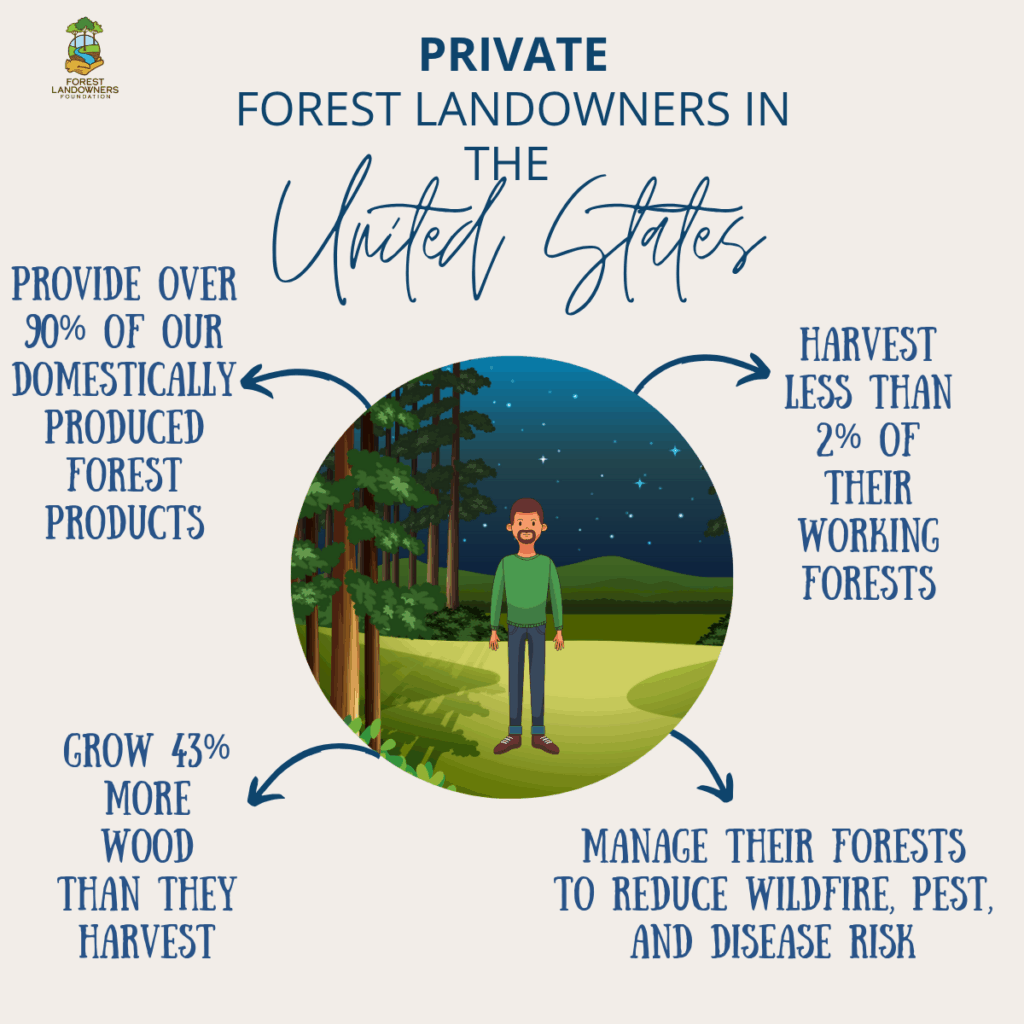

56% of forests in the United States are privately owned — and cared for by families, individuals, and small businesses who keep forests as forests.

These working lands provide clean water, wildlife habitat, renewable wood products, and climate benefits — while supporting jobs and rural communities across the country.

But forest stewardship is no small task. Landowners face rising costs, extreme weather, succession challenges, and a need for reliable information in an ever-changing landscape.

That’s where the Forest Landowners Foundation comes in.

We are the only national foundation solely dedicated to supporting private forest landowners. Our mission is to invest in the people behind the trees — providing them with the tools, training, and knowledge to keep their forests healthy, productive, and in family hands for generations to come.

Support the future of America’s forests by investing in the landowners who make it possible.

Prefer to mail in your donation? You can use our online form and mail your check to:

Forest Landowners Foundation, Inc.

PO Box 31354

Charlotte, NC 28231

Interested in other ways to give, such as stock donations or estate plans? Contact us for more information at apalmer@forestlandowners.com.

Note: A one-time development support fee of 5% will be assessed on all donations to the Next Generation program or the Endowment. The fee is not an additional cost to the donor but a restriction of 5% of the gift. For example, if a donor makes a $1,000 gift to the Next Generation program, $950 would be restricted to the Next Generation fund for programming, and $50 would be restricted to the Development Support Fee account for Foundation operations.

When you give to the Foundation, you help us:

- Deliver practical education and resources directly to landowners

- Grow the next generation of forest professionals and land stewards

- Share the story of working forests and the people who sustain them

Your donation is tax-deductible — and deeply impactful.

Why Do You Donate?

Joe Hopkins, 4th Generation Georgia Forest Landowner

“No other organization has the central purpose to sustain the forest landowner, not just the forest. By supporting the Forest Landowners Foundation, I’m supporting the future of my forest, the future of forestry, and the future of my family.”

Did You Know?

Due to tax law changes and increases in the Standard Deduction, many people no longer receive tax benefits when making charitable contributions. For those over the age of 70 and a half, an often overlooked option is to make donations directly from an IRA to the Forest Landowners Foundation, without having to claim the distribution as income. Not claiming this income is equivalent to receiving a charitable deduction. It’s called the Qualified Charitable Deduction (QCD). Properly structuring QCDs can save close to $10,000 in taxes for married filing jointly taxpayers in the highest tax brackets. As always, consult your tax advisor concerning this valuable option.